How AI-driven discovery is reshaping the path to purchase and what it means for SEO and marketing in 2026

For over a decade, search engine optimization has been built on a simple premise: rank higher on Google, get more traffic. But in 2025, a new discovery layer is emerging that changes where buying decisions begin.

LLMs like ChatGPT, Gemini, Claude, Copilot, and Perplexity now sit between search and purchase, functioning as both research assistants and recommendation engines.

The Previsible State of AI Discovery Report report analyzes 1,963,544 LLM-driven sessions across 12 months (November 2024 to November 2025) from sites across SaaS, e-commerce, finance, legal, health, and publishing.

The data reveals clear patterns: AI traffic is small in aggregate (0.13% of total sessions) but concentrated on high-intent pages, growing fastest in complex categories, and behaving fundamentally different from traditional referral sources.

Key Findings

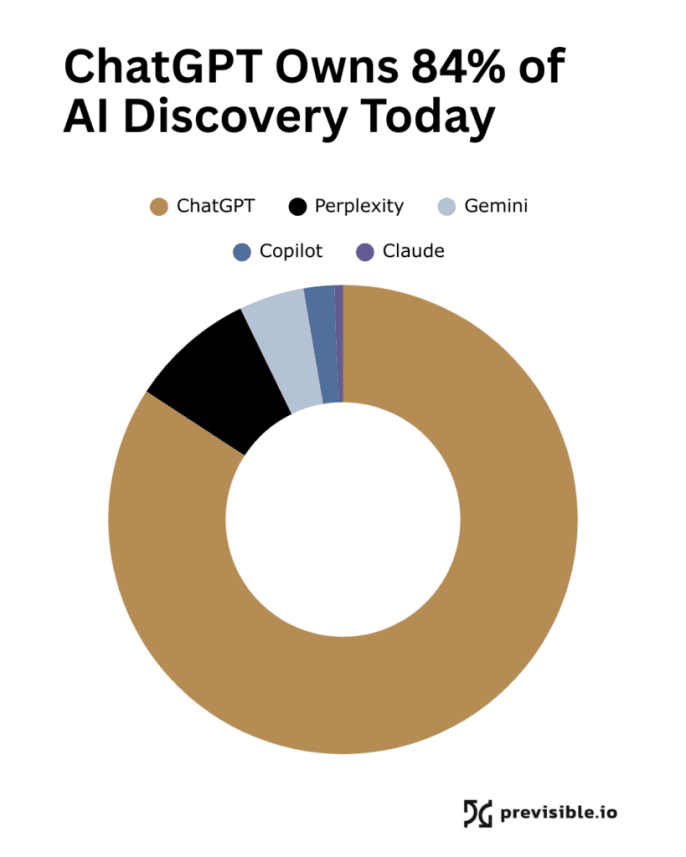

- ChatGPT owns 84.2% of AI referrals, growing 3.26x year-over-year to establish itself as the default AI discovery interface

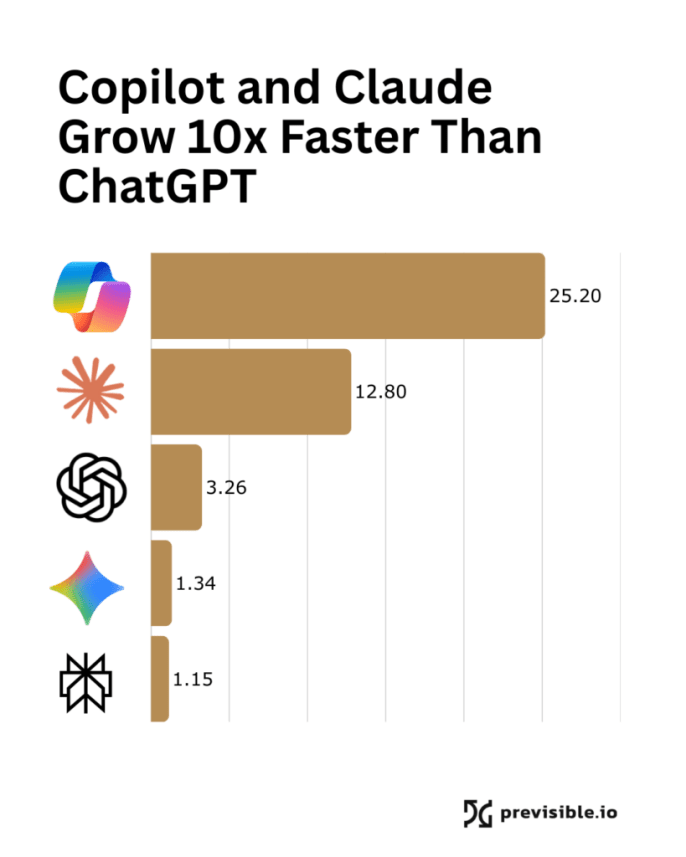

- Copilot (25.2x growth) and Claude (12.8x growth) show explosive expansion, signaling AI discovery is moving into embedded workplace tools

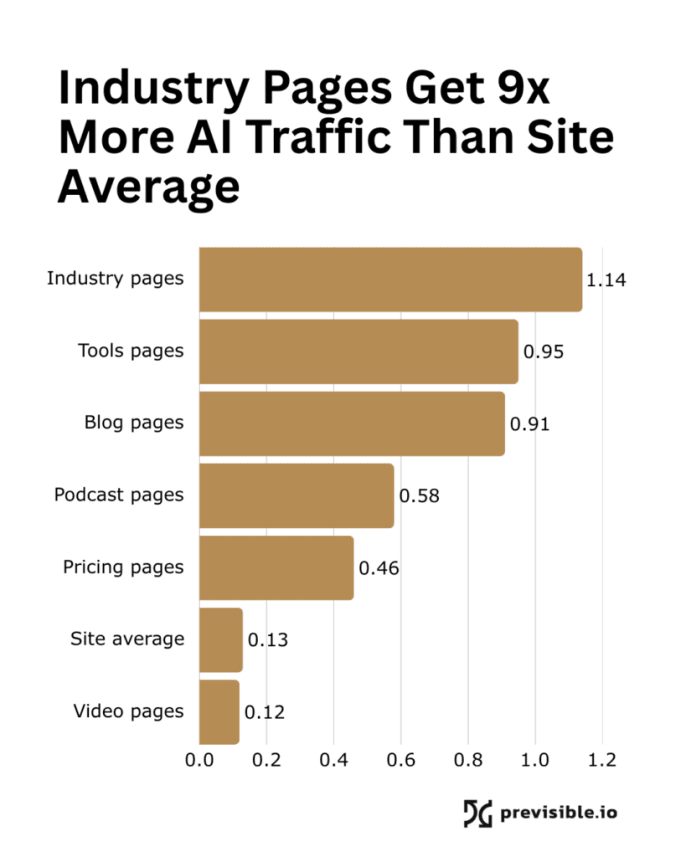

- AI concentrates on decision pages: Industry pages (1.14% penetration), tools (0.95%), and pricing (0.46%) show 4-9x higher AI presence than the 0.13% site average

- YMYL industries lead adoption: Legal (11.9x), finance (2.9x), and health (2.9x) show AI penetration accelerating fastest where stakes are highest

- E-commerce AI surges seasonally: Penetration jumped 67% month-over-month during November 2025 holiday shopping, reaching 0.19%

Understanding AI Penetration: Why 0.13% Matters More Than It Looks

AI penetration rate measures what percentage of total traffic comes from LLMs:

AI Penetration = (LLM Sessions ÷ Total Sessions) x 100

Across all analyzed sites, AI represents just 0.13% of traffic, roughly 1 in 769 sessions. This seems negligible until you examine where that traffic lands.

This scarcity isn’t a failure of optimization; it is a feature of the system. In a recent Hard Fork interview, Cloudflare CEO Matthew Prince quantified this friction, stating that getting a referral click from OpenAI is ‘750 times more difficult’ than from the traditional web. The architecture of LLMs is designed to retain users, not route them. Consequently, the traffic that does escape these walled gardens is no longer accidental—it is deliberate, high-intent, and hard-won.

The metric can be calculated at different levels: site-wide, by industry, or by page type.

Why this matters: AI traffic doesn’t distribute evenly. It concentrates on pages where users evaluate options and make decisions, pages that disproportionately drive revenue.

ChatGPT Owns 84.2% of AI Traffic, But Copilot and Claude Are Growing 10x Faster

Of 1,963,544 total LLM sessions from November 2024 through November 2025:

| Source | Total Sessions | Share | Nov 2024 | Nov 2025 | Growth |

| ChatGPT | 1,653,453 | 84.2% | 47,606 | 155,042 | 3.26x (+226%) |

| Perplexity | 169,614 | 8.6% | 11,732 | 13,508 | 1.15x (+15%) |

| Gemini | 88,756 | 4.5% | 5,598 | 7,507 | 1.34x (+34%) |

| Copilot | 40,391 | 2.1% | 180 | 4,534 | 25.2x (+2,419%) |

| Claude | 11,330 | 0.6% | 133 | 1,702 | 12.8x (+1,180%) |

ChatGPT peaked at 204,352 sessions in October 2025, 4.29x its November 2024 baseline, establishing itself as the default interface for AI-driven discovery.

However, and despite the small current volume, Copilot and Claude’s explosive growth rates matter because of where they live. Copilot is embedded in Microsoft Office, where millions work daily. Claude powers code editors and professional workflows.

As AI integrates into existing tools, discovery happens at the moment questions arise, not after users decide to open ChatGPT.

What this means: Brands that optimize only for ChatGPT visibility will miss the shift toward workplace-embedded AI discovery. The future isn’t one AI interface, it’s AI integrated everywhere users already work.

34.2% of AI Traffic Lands on Search Pages, But Pricing Shows 3.5x Higher Penetration

AI users don’t arrive randomly. They land disproportionately on pages associated with evaluation and decision-making.

Volume Tells One Story: Search and Blogs Dominate*

By raw sessions, AI traffic concentrates where page count is highest:

- Search pages: 324,204 sessions (34.2% of all AI traffic)

- Blog pages: 135,526 sessions (14.3%)

- Product pages: 56,926 sessions (6.0%)

- Pricing pages: 40,756 sessions (4.3%)

- Support pages: 35,789 sessions (3.8%)

*Other categories and uncategorized pages are not represented in this list.

Penetration Tells Another: Decision pages are 4-9x more relevant to users.

When measured as percentage of total traffic on each page type:

| Page Type | AI Penetration | vs. Average |

| Industry pages | 1.14% | 9x higher |

| Tools pages | 0.95% | 7x higher |

| Blog pages | 0.91% | 7x higher |

| Podcast pages | 0.58% | 4.5x higher |

| Pricing pages | 0.46% | 3.5x higher |

| Site average | 0.13% | baseline |

| Video pages | 0.12% | 0.9X (near baseline) |

AI doesn’t send users to browse, it sends them to compare, evaluate, and decide. Industry, tools, and pricing pages show the highest concentration despite having far fewer URLs than blogs or search.

Pricing Pages: 40,756 Sessions on a Single URL Shows Purchase Intent Migration

Pricing is the most revealing signal in the dataset. Despite being typically just one page per site:

- 40,756 AI sessions landed on pricing over 13 months

- 0.46% AI penetration, 3.5× the site average

- 4.3% of all AI traffic funneled to this single page type

On a per-page basis, pricing is one of the most AI-dense surfaces in the dataset.

Compare this to blogs: blogs attract more total AI sessions (135,526) but are spread across thousands of URLs. Pricing shows concentrated commercial intent.

What’s happening: When users ask AI “how much does [product] cost” or “compare pricing for [category],” they arrive at pricing pages with purchase intent already formed.

Pricing page optimization is now moving beyond conversion rate alone and it’s becoming key in AI discoverability.

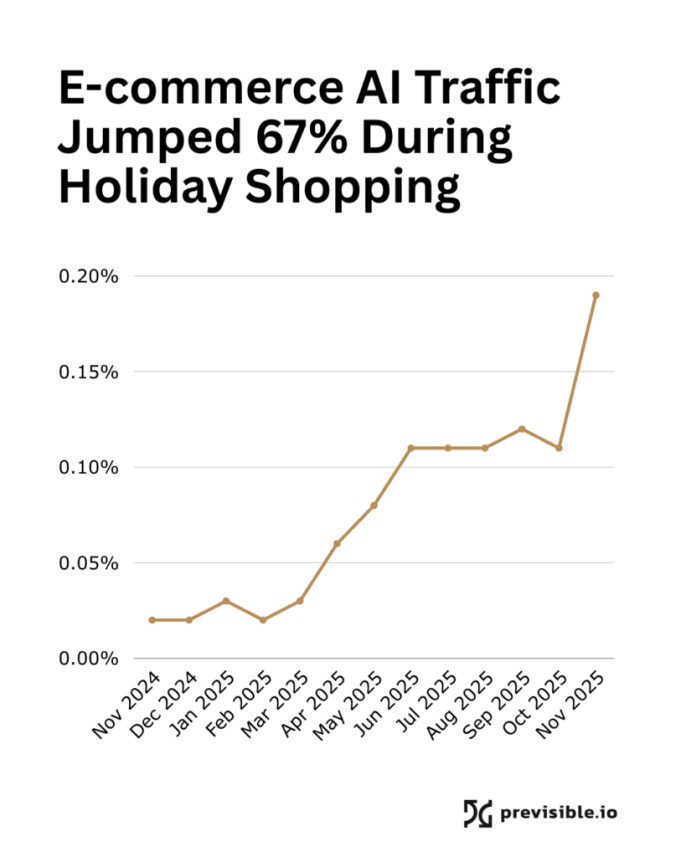

E-commerce AI Penetration Jumped 67% During Holiday Shopping Season

E-commerce showed one of the most dramatic seasonal patterns, with AI penetration surging during peak commercial periods:

| Month | AI Penetration | Change |

| September 2025 | 0.12% | — |

| October 2025 | 0.11% | -8% |

| November 2025 | 0.19% | +67% |

Year-over-year e-commerce AI penetration increased 10.5x, from 0.02% to 0.21%.

What this reveals: Consumers turn to AI for product research when purchase stakes are highest (during Black Friday, Cyber Monday, and holiday gifting). AI visibility matters most when shopping intent peaks and consideration sets form.

Legal (11.9x), and Finance (2.9x): YMYL Categories Adopt AI Fastest

AI penetration is accelerating fastest in categories where decisions carry real consequences, what Google calls YMYL (Your Money or Your Life) content:

| Industry | Nov 2024 | Nov 2025 | Growth | Category |

| Legal | 0.08% | 0.95% | 11.9x | YMYL |

| Finance | 0.49% | 1.43% | 2.9x | YMYL |

| Health | 0.20% | 0.48% | 2.4x | YMYL |

Why YMYL accelerates fastest: When stakes are high, financial decisions, legal compliance, health choices, users want synthesis, comparison, and expert-level explanation. AI excels at exactly this.

As AI becomes the starting point for YMYL research, being cited by AI systems functions as an authority signal, similar to traditional media mentions. For organizations in YMYL categories, AI visibility increasingly influences trust formation.

SaaS Users Research, E-commerce Buyers Skip to Products: AI Discovery Paths Vary by Industry

AI doesn’t route all industries to the same context. Where LLM traffic concentrates reveals fundamentally different buyer journeys by vertical:

Page Type Distribution by Industry

| Industry | Top 3 Landing Pages | % of AI Traffic | Pattern |

| SaaS | Search (41.9%), Blog (19.9%), Pricing (16.4%) | 78.2% | Traditional research journey |

| E-commerce | Product (41.1%), Search (19.4%), Blog (16.6%) | 77.1% | Direct to purchase intent |

| Finance | Course (34.1%), Courses (14.5%), Guide (14.2%) | 62.8% | Education-first discovery |

| Health | About (38.8%), Search (27.8%), Blog (13.0%) | 79.6% | Trust verification first |

| Legal | App (26.4%), Location (25.1%), Contact (20.7%) | 72.2% | Utility-driven, not content |

What This Means

For SaaS

SaaS success in AI discovery depends on clearly understanding which pages drive consideration and brand resonance and tightly connecting that journey to transparent, comparable pricing signals.

For E-commerce:

41% of LLM sessions land directly on product pages. When users ask “best running shoes for flat feet,” AI sends them to products with purchase intent formed. For e-commerce brands, a focus on data utility is critical: structured, comparable product data across PDPs powers AI-led comparison, shortens decision cycles, and captures users with purchase intent already formed.

For Finance:

In finance, sustained AI visibility comes from educating users before selling, building structured learning paths that meet consumer expectations and guide trust, confidence, and eventual conversion. 63% of AI traffic lands on educational content (courses, guides). Helping financial buyers to learn before they buy.

For Health:

39% of health related searches land on “About pages” first. In YMYL categories, users verify credibility before engaging. Health brands win in AI environments by maintaining strong trust signals, authoritative citations, and credible placements that reinforce legitimacy within their broader ecosystem.

For Legal:

Legal discovery is fundamentally utility-driven: users arrive with context and urgency, seeking tools, locations, and experiences that help them solve a specific problem immediately. 72% of discovery arrives on functional pages (apps, contact, location), not generalized content. Legal needs are utility-driven. Ensure tools and contact pages are discoverable.

One-size-fits-all AI optimization doesn’t work. The pages you prioritize should match where AI actually sends users in your vertical. This will inevitably change as models evolve and consumers refine discovery within LLMs.

The Multimodal Opportunity: How Video and Podcasts will scale in 2026

As AI discovery accelerates, multimodal content is emerging as a driver of visibility and recall. Heading into 2026, we expect video and audio formats to receive heightened exposure in AI-generated responses, particularly as models prioritize richer contextual understanding and conversational depth. Today, it’s not volume but format-aligned usefulness that determines what LLMs surface next. Here are AI Content Penetration rates:

- Video pages: 0.12% (near site average)

- Podcast pages: 0.58% (4.5x higher than average)

Podcasts show elevated penetration as they often have transcripts or show notes that current AI systems can parse. Video sits near baseline with most AI environments still limited in the processing of video content.

But why this is a leading indicator, not a limit:

Multimodal AI capabilities are advancing rapidly. As models gain ability to process video and audio natively:

- Metadata, descriptions, and structured content around multimedia will become critical for discoverability

- Video and podcast discovery will shift from platform algorithms to AI recommendations

- Brands investing in video/audio content should prepare for AI-mediated distribution

As multimodal capabilities mature, surfaces combining text, audio, and video are positioned to capture significantly larger AI attention share.

What SEO and Marketing Teams Should Do in 2026

AI-driven discovery doesn’t replace SEO, it changes where effort compounds. Based on where AI traffic concentrates and which page types show elevated penetration:

1. Prioritize Industry and Search Content : 40%+ of AI Traffic Lands Here

Industry and internal search pages are the primary entry point for AI-referred users, signaling high-intent discovery where users arrive with defined problems and expectations.

Actions:

- Audit internal search quality for commercial queries

- Surface industry pages, tools, and product content prominently

- Treat search UX as acquisition strategy, not just navigation

2. Optimize Pricing for AI-Driven Buyers: 0.46% Penetration on One Page

Pricing shows 3.5x higher AI presence than site average. Users arrive ready to compare and decide.

Actions:

- Make pricing transparent, scannable, and easy to compare

- Add implementation details, limitations, and integration context

- Remove ambiguity. AI users want confirmation and clear paths.

3. Structure Content for “What Should I Use?” Questions

AI discovery is shaped by recommendation-style queries.

Actions:

- Map content to comparison and selection prompts

- Explicitly state who your product is best for (and who it’s not for)

- Use clear headings, concise explanations, and logical flow so models can summarize cleanly

Other Recommendations:

Track AI by Page Type, Not Just Site-Wide

The total organic AI traffic share of 0.13% site average hides where AI matters. Measuring only in aggregate creates blind spots.

Actions:

- Monitor AI concentration on industry, tools, pricing, and search pages

- Track penetration changes month-over-month by page type

- Use page-level performance as an early signal, not lagging indicator

Prepare for Multimodal: Video/Podcast AI Is Coming

Current penetration is modest (0.12% video, 0.58% podcast), but multimodal capabilities are advancing rapidly.

Actions:

- Invest in metadata, descriptions, and structured content around multimedia

- Optimize for AI-driven distribution, not just platform algorithms

- Consider how video/audio will be discovered in conversational interfaces

Early Positioning Creates Compounding Advantages

AI discovery is evolving faster than any traditional organic SEO strategy ever has and that pace of change is the point. Success is no longer about producing more content, but about investing in high-value data signals that reflect how and where discovery is actually shifting. Traffic alone won’t be enough; not all traffic contributes equally to how LLMs evaluate, summarize, and recommend brands. What matters is whether your presence aligns with the decision-making surfaces LLMs rely on.

Looking ahead to 2026, we expect events and event-driven interactions across a site to become a critical signal, markers of intent, progression, and completion within a user journey. LLMs are increasingly optimizing for end-to-end outcomes, not just answers. There’s a reason ChatGPT and Stripe introduced Agentic Commerce Protocol with instant checkout at its core: the future of AI discovery is about enabling full decision journeys inside the interface itself. It’s likely that Gemini, Copilot, and other LLM ecosystems will follow with partnerships that allow users to evaluate, decide, and transact without ever leaving the AI experience.

As AI embeds itself into productivity tools, shopping flows, and research workflows, discovery no longer starts with a search box, it starts where questions arise. When LLMs handle early comparison and filtering, upstream visibility becomes the gatekeeper to consideration. Brands that appear in AI summaries get evaluated. Those that don’t are filtered out before traditional search ever begins.

The future of discovery isn’t ranking higher, it’s being present where decisions are made.

Navigate the future of search with confidence

Let's chat to see if there's a good fit

SEO Jobs Newsletter

Join our mailing list to receive notifications of pre-vetted SEO job openings and be the first to hear about new education offerings.